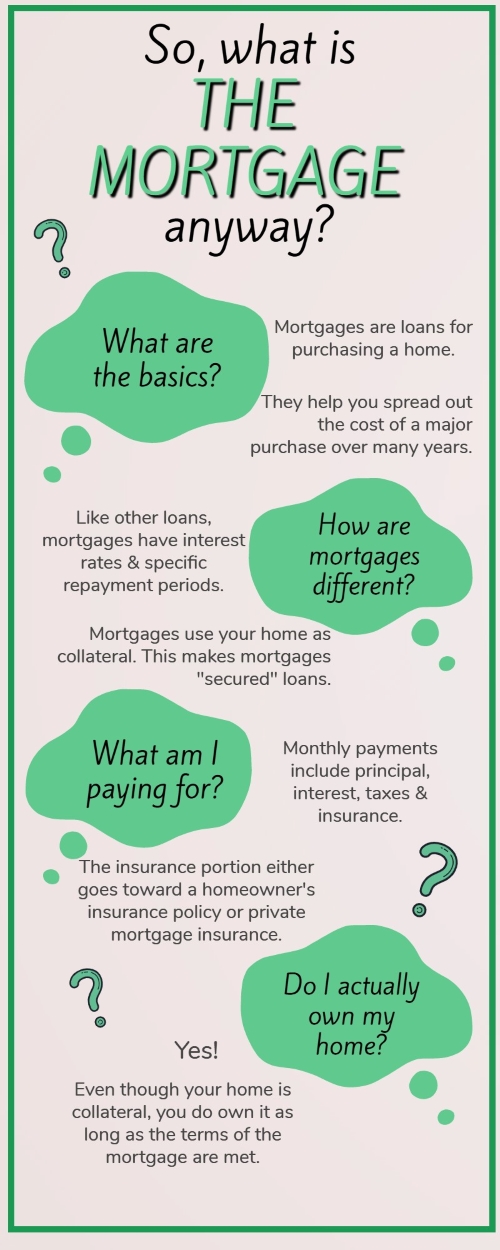

For many, the concept of buying property seems completely unfamiliar - and paying for it might make you wonder, “what is ‘the mortgage,’ anyway?” If you’ve rented a house or apartment before, you’re familiar with monthly payments and extra fees for maintaining the property. But how is a mortgage different?

To help you gain a better understanding of what a mortgage actually is and how it works, here is a quick guide to the basics:

You can think of mortgages similar to car loans. You pay monthly repayments with fixed interest until you pay off the loan.

Mortgage loans work because only few buyers have the money they need up front to make this kind of huge purchase. Instead of paying out-of-pocket, a mortgage helps you spread your purchase costs over several years, allowing you to buy homes at lower costs.

Mortgage loans have interest rates and agreed upon repayment periods like any other loan. However, some important distinctions distinguish mortgage loans from other types of loans.

A mortgage is a secured loan, which means it requires collateral - an asset the lender can seize if you default on the loan. In the case of mortgages, the property itself is collateral.

An unsecured loan doesn’t require collateral, but may have higher interest rates or minimum qualifications to help the lender mitigate risk.

You pay your mortgage payment monthly. Mortgage loans comprise four major costs: principal, interest, taxes and insurance. Principal is the actual amount of money you borrow, and interest is the percentage that goes back to the lender.

Property taxes and insurance also factor into your monthly payment. Insurance could be either mortgage insurance or homeowners insurance, depending on which type you have.

Buying a home means you’re responsible for making decisions about the property, but a mortgage can make the concept of ownership confusing. However, the simple answer is yes, you do own your home as long as the terms of the mortgage are met.

Even knowing the basics about a mortgage loan, the process can seem daunting. However, this key information will help guide you through the process of becoming a homeowner.

For over 11 years, I have been following my passion of helping people find their dream homes and sell them when the time is right. First time home buyers, growing families, empty nesters looking to downsize. I guide my clients every step of the way, from initial consultation through final closing. By bringing an experienced eye and a fresh approach to every situation, I work diligently with each client to smooth the process and make it as stress-free as possible.

Fair representation, respect and integrity. Clear communication and detailed coordination. A commitment to putting my clients' needs first. These are the practices and values my clients expect and enjoy.

I also work with a wide network of trusted experts in financing, legal assistance, home inspections, evaluation and interior design. Everyone has the same high expectation of providing the utmost service through close communication and coordination to get our client to the end goal of selling or moving into their dream home!

Outside of real estate, I have a deep passion for travel. My husband and I have been fortunate to explore many incredible destinations around the world, and we always look forward to planning our next adventure. I also find joy in gardening and flower arranging—my personal ‘Zen moments’—as well as reading, practicing Pilates and spending time with my family!